Saw a copy of the following running around on Facebook this week:

This makes a few claims:

- That Social Security and Welfare are similar.

- Social Security is in danger of running out of money.

- Welfare isn't.

- That Social Security is only received by those who worked for it.

- That Welfare is only received by those who don't work at all.

- It's right for people who worked for money to receive benefits.

Let's address them one at a time:

SOCIAL SECURITY

Social Security is run by the Social Security Administration, an independent agency within the government. Its website explains that it "is financed through a dedicated payroll tax" of 12.4% of your income, half of which is paid by your employer if you are not self-employed (

source). Only your income up to $118,500 is taxed in this way - anything above that is tax-free, meaning that someone earning $1,000,000 per year is paying an effective tax of 1.47%.

Social security benefits are determined as follows:

We base Social Security benefits on your lifetime earnings. We adjust or “index” your actual earnings to account for changes in average wages since the year the earnings were received. Then Social security calculates your average indexed monthly earnings during the 35 years in which you earned the most. We apply a formula to these earnings and arrive at your basic benefit, or “primary insurance amount.” This is how much you would receive at your full retirement age—65 or older, depending on your date of birth. (source)

So, someone who works *ever* - such as someone who works for two years and then quits (explained below), to retire, go on medical leave, disability, etc - is eligible for benefits. The amount of the benefits are determined by how much the person puts into the system.

Retirement age was raised a few years back so that anyone born after 1960 cannot retire until 67 to receive full benefits. (Interestingly, if you work until 70, you can earn more per year - quite substantially more, in fact. For me, it'd be almost 25% more.)

Social Security also pays disability or death benefits. When someone dies and leaves behind minor children, those children (and their remaining parent) earn a very significant amount of money (more combined than if the dearly departed had gone on disability, and disability is roughly equivalent to retiring at full retirement age) until the child is 18.

Before we get into "Welfare," I'd also like to throw in Medicare, since that is funded in a similar manner as Social Security. It's a flat 2.9% (half for employer, as above); however, Medicare *has no cap*. This will become important to the discussion later.

WELFARE

When we speak of Welfare as a thing different from Medicare or Social Security, we refer to 77 separate programs providing a variety of assistance - from food programs (such as SNAP benefits and school lunch programs) to housing (most notably HUD), to education (Pell Grants, Even Start, Title One, and so on), to medical (most notably Medicaid), to child care (notably Head Start), to community development, and on and on.

What we

imagine, however, is something a bit different: an organization within the government that is tasked with handing out a 700 billion dollar chunk of cash, that looks for people who are not working at all and pays them to stay at home and pop out babies. If this department exists, it exists as Temporary Assistance for Needy Families (or TANF).

That imagery - and specifically the idea of the "Welfare Mother" who was predominantly black and single, and who had kids just to earn money on welfare without having to work - was a big part of the 1990s welfare reform movement that culminated in the 1996 Personal Responsibility and Work Opportunity Reconciliation Act, which reformed the branch of welfare known now as TANF (formerly Aid to Families with Dependent Children, or AFDC).

Of that 700 billion the federal government spends annually on Welfare programs not counting Medicare and Social Security, less than 7 billion, or less than 1%, goes into TANF. (States pay a roughly equal amount into the program.) This comes out of the general tax and is determined by the federal budget - meaning that Congress has complete control over how much is put into this and other Welfare programs each year, and the revenue stream is not dedicated.

TANF is notably temporary; that is, it lasts for a maximum of 2 years

at a time, and up to 5 years over a lifetime. No one who is earning it

is staying at home for their entire lives farming TANF.

Even

if they were, which they're clearly not, TANF's maximum payout is

abysmal. Last year, the Congressional Research Service put out a report

titled

Temporary Assistance for Needy Families (TANF): Eligibility and Benefit Amounts in State TANF Cash Assistance Programs.

You don't need to read the mere 31 pages of awesomeness - the abstract

alone is a gold mine. It explains the problem with maximum benefits:

In

July 2012, the state with the lowest maximum benefit paid to a family

consisting of a single parent and two children was Mississippi, with a

benefit of $170 per month (11% of poverty-level income). Among the

contiguous 48 states and the District of Columbia, the highest maximum

benefit was paid in New York: $770 per month for a single parent of two

children in New York City (48% of poverty-level income). The benefit for

such a family in the median state (North Dakota, whose maximum benefit

ranked 26th among the 50 states and District of Columbia), was $427, a

benefit amount that represented 27% of monthly poverty-level income in

2012. TANF maximum benefits vary greatly by state; there is also a very

apparent regional pattern to benefit amounts. States in the South tend

to have the lowest benefit payments; states in the Northeast have the

highest benefits.

$170 per month. And, while

such a person is also eligible to receive some other limited benefits

(HUD benefits to provide Section 8 housing, SNAP benefits to provide

some food), such a person is still far below the poverty line, and

definitely struggling to earn enough to keep children in clothes, much

less fed and secure enough to do well in school.

So, what's the bottom line for #1?

Social Security is a social welfare program, but it is not similar to TANF or any other welfare program besides Medicare. It relies on a dedicated funding stream, and provides benefits for much longer periods of time than other social programs.

Social Security is running out of money:

Social Security has several problems; notably:

- People are living longer.

- Baby boomers are in their retirement years.

- Richer people are earning more.

People are living longer

This graph shows how life expectancy in the US has increased from 1960 to 2013. In 1960, it was roughly 70. That meant that the average person could expect to die 5 years after he or she started to receive social security benefits, so those benefits only had to be paid out for 5 years (on average). Today, it's almost 79. Even with the increase in the age at which people start receiving benefits (to 67), that's 12 years of benefits - an increase of 240%.

Baby Boomers are retired

Baby Boomers are those people who were born shortly after WWII, when soldiers returned home from war and celebrated by avoiding being celibate. Birth rates since have somewhat declined, as shown by

this graph.

We normally expect age distribution to be somewhat exponential - with a greater number of children than the number of adults producing them. That is not, however, what we see:

|

| http://www.indexmundi.com/united_states/age_structure.html |

While the top of the curve looks like we expect, it's largely to do with how quickly people die off as they get older. Consider, though, that in that chart, almost everyone over 65 is receiving social security benefits - to the tune of 56 million people today.

The rich are getting richer

Meanwhile, income hasn't substantially increased for the majority of Americans. Wages have remained basically stagnant for the last 40 years for the bottom 60% of earners:

Meanwhile, as is clear from that graph, the top 20% are earning quite a lot (and as I'm sure you've heard, the growth for the top 1%

has been massive).

This isn't a gripe about income disparity; rather, it affects Social Security along with the other two points.

Social Security is a kind of pyramid scheme. When you pay into the system, you aren't putting money away for your own future - rather, that money is going to pay for the Social Security benefits of people currently receiving them. For Social Security to be successful, it requires two things: growing population and growing wealth. These two things mean more money coming in than going out. But when population is distributed the way it is now, the system becomes top-heavy, with too many people receiving funds.

This would be fine if income was also growing. It's the multiplication of people times per capita income that tells us how much income is getting taxed. If income grows substantially, then population doesn't have to.

And income

is growing substantially, but only for those already earning more than the maximum taxable amount. Take a look at that chart again, and you'll see that the top line - the top quintile - on average has earned more than the maximum taxable rate the entire time, and it's the line that has been substantially growing. All of the big income gains we've made haven't helped Social Security one jot.

It's for this reason that

Bernie Sanders is calling for an end to the tax cap. As I hope you can see, it's very much needed. The alternative is to continue raising the Social Security tax rate, or the eligible age, or both (as we've done several times in the past).

Welfare isn't running out of money

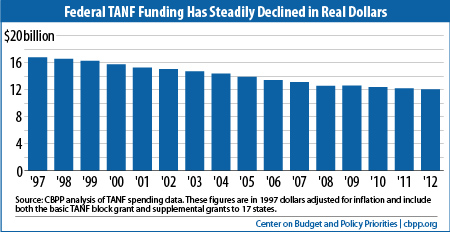

Welfare works, as noted, quite a bit differently. The 700 billion that funds non-SSA, non-Medicare welfare programs comes out of the general federal budget, rather than a dedicated revenue stream. For this reason, it's dependent upon the whims of Congress each year. While many welfare programs have grown in size and budget over the past 50 years, TANF - the one I mentioned earlier is the one we really think of when we think of welfare, has shrunk:

Meanwhile, Food Stamps and Medicaid have grown:

The 2008 economic downturn caused dramatic growth in the number of people seeking benefits - growth that far outpaced budget. SNAP benefits

had to be dramatically reduced as a result. So, when we say "Welfare never runs out" - that's not quite true. That said, it's theoretically easier for Congress to raise taxes and increase welfare spending than for it to change how Social Security works. It just depends on who is in control of Congress as to whether or not that happens:

Do people who receive Social Security earn it?

Well, that depends on your definition of "earn," but using what I imagine the proponents of the progenitor argument would say is "receive in due course as a result of working and paying into the system."

If that's their definition, then the answer is "sort of."

You have to have done

some work to receive Social Security. That's because Social Security also pays out for disability and death. In both cases, you may be able to qualify with a surprisingly small number of work hours. Age and situation play into it a lot, but a "worst case" would be for someone under the age of 24 who becomes disabled. Such a person only needed to earn 6 "credits." Credits are a special system Social Security uses to determine eligibility:

In 2015 ... you earn one credit for each $1,220 of wages or

self-employment income. When you've earned $4,880, you've earned your

four credits for the year. (source)

That's only 673 hours of work at minimum wage (you get about 2080 in a full time year). You can only get 4 credits per year, so such a person would've needed to work at least 337 hours in a previous year.

That's relatively easy to achieve. Even in the best case scenario of someone who became disabled at age 62, such a person only needed to put in 4 credits a year for 10 years (

source).

Sure, the benefits might not be much. Someone aged 20 who goes on disability right now and earned only $7500 in the last 3 years would get $187 monthly, or $2,244 yearly (

per the online calculator). But that's yearly for life - so if that person lives another 55 years, he or she will receive over $100,000 - well in excess of the amount paid in.

And the Social Security Administration estimates that 25% of people will become disabled at some point before retirement (

source).

Do people who receive Welfare earn it?

Using the same definition of "earn" as above, the answer is still "sort of." The difference in terms of "earning it" between welfare programs other than Social Security and Social Security is that the funding source isn't

dedicated - that is, you don't pay into a fund and get guaranteed payout as a result.

But it's a mistake to think that people on Welfare haven't worked.

According to a report jointly from UC Berkeley's Center for Labor Research and Education and the University of Illinois at Urbana-Champaign's Department of Urban & Regional Planning, "Nearly three-quarters (73 percent) of enrollments in America’s major public benefits programs are from working families" (

source). They appear to be counting among those programs the Earned Income Tax Credit (EITC), SNAP, TANF, and Medicaid.

You might say, "well fine, that means 27 percent didn't." But among those 27%, we don't know the story - it's possible such people are disabled like in the SSA estimates. It's possible they're on unemployment and just waiting for something to come in. According to the likely-biased (though they claim none) Center on Budget and Policy Priorities, "more than 90 percent of the benefit dollars that entitlement and other mandatory programs spend go to assist people who are elderly, seriously disabled, or members of working households — not to able-bodied, working-age Americans who choose not to work" (

source). Just looking at SNAP benefits, they estimate that 82% of households had at least someone working in the past year (

source).

Sadly, better statistics on this subject are not available.

But, just from these, it seems a false narrative to say that people on welfare don't work - rather, the vast majority do work, but are paid abysmally.

It's right for people who worked to receive benefits.

I agree. That's why I support welfare. However, it is true that welfare helps keep people in dependency - not because of welfare, but

because corporations are abusing welfare to get out of having to pay livable wages.

If you believe that welfare causes dependency, then you should support increasing minimum wage to help pull people out of that dependency.

If not, then you're just a horrible person.